Light Painting is infact super simple once you know what you're doing. I learnt how to do it in 20 minutes. An hour later and I've got 4 shots I'm happy with and edited (saturation, ambience and a little contrast)

So you will need -

An area that can be in darkness,

A subject

A light, or two, three, whatever

Your camera.

Here's an indepth of what to do.

In the light, set up your camera either on a table or on a tripod so it can't move. Set up your subject, get your manual focus right and then adjust your camera settings.

Settings I used - Manual, ISO 100, f18, shutter speed 20 seconds.

Now get your area in darkness, get your torch or light source ready. Press down your shutter button and start with your painting.

Random movements work well but so do precise movements, it's all child's play really.

Make sure you don't get your hands in the shot too much as this will affect the outcome.

Your shutter will close. And your done! Turn back on your lights and see what you've done.

My 4 shots taken on the canon 600d with kit lens of a diesel aftershave bottle using the iPhone flash as a torch with the app iTorch.

Happy painting!

How To: DIY DSLR Pop Up Flash Snoot , Diffuser & Filter

Following on from the DIY DSLR Pop-Up Flash Diffuser made from a milk bottle at a zero cost, I've now made a pop up flash snoot, diffuser and a filter all in one.

The total cost of this is nothing again!

(depending on what you have in your cupboards of course)

Pictures follow the post

Gather your materials: You will need:

A ruler, a marker pen, some foil, scissors, sellotape / glue, your camera, a gravy granule tube (Bisto), the Bisto lid or pringles lid and some kitchen roll or ripstop nylon or any diffusing material.

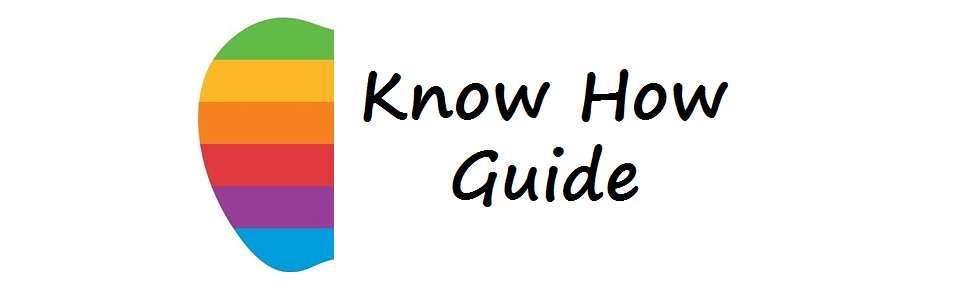

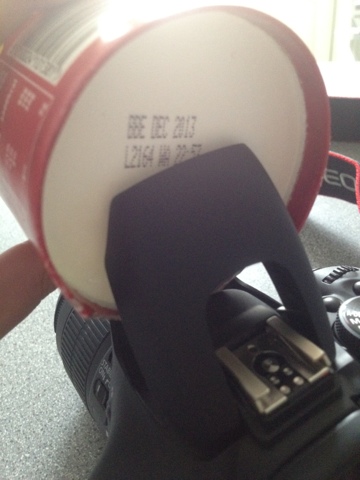

Step 1- Cut out part of the base rim out of the tub (this is so it fits better onto your pop up flash)

Step 2- Line up your flash, mark the edges, and cut out of the base of the Bisto.

Step 3- Now cut a square of foil big enough to line the tub. Scrunch it up to get more reflection. Then tape this down at the ends, trim to size.

Step 4- Cover your clear Pringles lid with your diffusing material, I used kitchen roll. And tape it down.

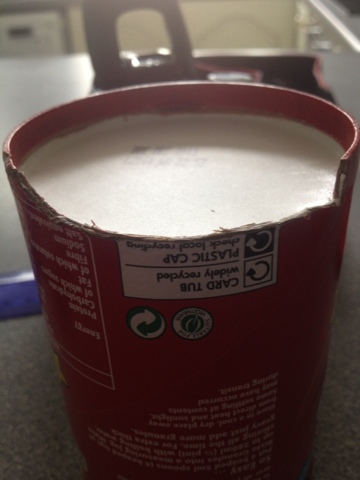

Step 5- Attach your lid to the Bisto tub, and voila! Your done!

Remove the lid and you've got your snoot.

Attach the diffused lid for your diffuser.

Attach the red Bisto lid for a red filter (no picture, but it works!)

Thanks for reading!

The total cost of this is nothing again!

(depending on what you have in your cupboards of course)

Pictures follow the post

Gather your materials: You will need:

A ruler, a marker pen, some foil, scissors, sellotape / glue, your camera, a gravy granule tube (Bisto), the Bisto lid or pringles lid and some kitchen roll or ripstop nylon or any diffusing material.

Step 1- Cut out part of the base rim out of the tub (this is so it fits better onto your pop up flash)

Step 2- Line up your flash, mark the edges, and cut out of the base of the Bisto.

Step 3- Now cut a square of foil big enough to line the tub. Scrunch it up to get more reflection. Then tape this down at the ends, trim to size.

Step 4- Cover your clear Pringles lid with your diffusing material, I used kitchen roll. And tape it down.

Step 5- Attach your lid to the Bisto tub, and voila! Your done!

Remove the lid and you've got your snoot.

Attach the diffused lid for your diffuser.

Attach the red Bisto lid for a red filter (no picture, but it works!)

Thanks for reading!

How To: DIY DSLR Pop Up Flash Diffuser

I've seen a great deal of DIY flash diffusers on google, all ranging in cost, some made from foam, some cardboard, some bubble wrap even! But typically you can only find DIY diffusers for external / hotshoe flashes.

However if you're like me and stuck with the pop-up flash for the time being, but still want a diffuser, then read on!

The DIY pop up flash diffuser - costs NOTHING!

(Pictures in sequence below)

What you'll need:

An empty milk bottle, ruler, sharpie / marker pen & scissors (and of course your camera)!

Step 1 - Mark out the bottle as per picture below, repeat on both sides, and link up your marks (behind bottle handle)

Step 2 - Cut it out, (If you're young, please get an adult to do it for you) you should be left with something looking like the picture.

Step 3 - Measure + mark the lens size as per picture. Then cut this out with your scissors (I also cut an extra notch to fit inside where the flash pops up from - see picture)

Step 4 - Cut the long piece of plastic - so that you can make a latch, you'll have to measure this yourself (you'll see what I done in the picture)

Step 5 - Make a slit in the plastic for your little latch to go through, this will act as a lock to stop it falling off.

And you're done! A totally free DIY DSLR pop up flash diffuser made from a milk bottle.

Happy snapping!

However if you're like me and stuck with the pop-up flash for the time being, but still want a diffuser, then read on!

The DIY pop up flash diffuser - costs NOTHING!

(Pictures in sequence below)

What you'll need:

An empty milk bottle, ruler, sharpie / marker pen & scissors (and of course your camera)!

Step 1 - Mark out the bottle as per picture below, repeat on both sides, and link up your marks (behind bottle handle)

Step 2 - Cut it out, (If you're young, please get an adult to do it for you) you should be left with something looking like the picture.

Step 3 - Measure + mark the lens size as per picture. Then cut this out with your scissors (I also cut an extra notch to fit inside where the flash pops up from - see picture)

Step 4 - Cut the long piece of plastic - so that you can make a latch, you'll have to measure this yourself (you'll see what I done in the picture)

Step 5 - Make a slit in the plastic for your little latch to go through, this will act as a lock to stop it falling off.

And you're done! A totally free DIY DSLR pop up flash diffuser made from a milk bottle.

Happy snapping!

How To - Reclaim PPI for FREE

You can reclaim £1,000s on PPI yourself, easily, for free. Don't hand 30% to a no-win no fee claims handler. Everyone who's got or had a loan, credit or store card, catalogue or car finance should check now if they were flogged these policies.

The banks lost in court after years of systemically mis-selling PPI. Now they've put up to £9 billion aside to pay out. This is a step-by-step DIY guide including a full FAQ and free template letters on how to join the millions who've complained and been paid back money wrongly taken from them.

STEP 1. CHECK YOUR POLICY

Not got your paperwork?

While it isn't always necessary, as you can start a reclaim without it, if you don't have a copy of your agreement or T&Cs you can contact your lender to ask for a copy (make sure T&Cs date back to the time of your agreement as terms will change over time).

Lenders can ask for £1 to provide this but not all do so you could include a £1 cheque (don't send cash, though) to speed it up a little. It may not provide the agreement if your account is closed but you can then ask for a full breakdown of your whole account (this can cost £10).

STEP 2. THE PPI MIS-SELLING CHECKLIST

Now it's time to go through the checklist below. Sellers of PPI have a responsibility to ensure you understand the nature of the product, and that it's appropriate for you. All policies will have exclusions, and you should have been told about them. As most policies are bought alongside a financial product rather than on their own, the key issue is:

... what was said at the point you were sold the product.

Here are the key mis-selling categories. If you fit one or more of these you probably have a case:

Were you told it was compulsory?

It's a common complaint that consumers are told they must buy a policy from the same provider as the loan in order to be accepted for the product. This is mis-selling.

Any company that subscribes to the Lending Code (see list) agrees it won't insist you buy an insurance product from it. Therefore if the salesperson:

- Didn't make it clear the policy was optional or tell you about any cooling off period

- Implied or stated it would be more expensive if you didn't take the insurance

- Implied or insisted you take out their policy to qualify for the product or help with your application

- Was very pushy when selling the product, so that you felt you could not say no

- Would not let you continue with the application if you did not sign the insurance agreement as well

Didn't realise you had cover?

Have you just checked your loan agreement to find that you've been paying for insurance, but didn't realise until now that you had it, or what it's for?

Some old agreements (pre-July 2007) may have used pre-ticked boxes so you had to opt out of the insurance rather than opt in, which is unfair. Always check this, and if you're paying for insurance you didn't know you had

Were you told or sold the wrong thing?

This covers anything from the fact you were already covered through work or your partner, the policy not being what you agreed to, the insurance term is shorter than your loan and you didn't realise, or if you thought it was a joint policy but in fact it was only in one person's name.

Self-employed, unemployed or retired?

If you were unemployed or retired, check if the policy included unemployment cover. If it did, the unemployment cover's worthless – this should've been pointed out.

If you were self-employed, check whether you were eligible for a payout if your business went bust (usually not) – if not, and it wasn't pointed out, you may have a case.

Had any medical problems in the past?

Most policies exclude existing medical conditions, meaning you're unlikely to be covered for any medical problems you've had in the past. You should've been asked about this, and informed the policy could be affected.

Has your provider already been fined?

The regulator, the FSA, has said it wants to see better practice. Many major providers, including Alliance and Leicester, Liverpool Victoria and Capital One have been fined for "not treating customers fairly". If yours has, it's very likely you've a case.

Write the company that sold the policy and ask for a refund. In the old days this often meant following a dance - thankfully it's much easier now. (You can easily find guides online)

The most important thing to understand is: don't be put off if you're rejected. You may also need to go to the Ombudsman later, but you need to have written to the lender first.

STEP 4. WRITE TO THE OMBUDSMAN

If you still haven't reached a satisfactory conclusion, it's time to make a formal complaint to the Financial Ombudsman Service.

This is the official independent service for settling disputes between financial companies and their customers. The Ombudsman is completely free to use, and will adjudicate on whether your complaint should be paid out.

It'll decide whether your policy was sold unfairly or unreasonably (see some examples). It can only do so once eight weeks have passed from the date of your first complaint letter (between June and Dec 2011 banks had 12 weeks to deal with complaints), unless your case was put on hold by the lender and it specifically suggests you go to the Ombudsman (although this should no longer be happening).

While the process of using the Ombudsman is simple, and the amount of money you could receive is massive, it's not usually quick. Your case may take over a year to be settled, so don't count on the cash now.

How to make a complaint

Just contact the Ombudsman and ask it to take on your case. You can either do this via the Financial Ombudsman Service website or by calling 0800 0234 567 (or 0300 123 9123 from a mobile). It will look at each case individually, so if yours is a matter of you saying one thing happened but the company disagrees, the Ombudsman will decide if it thinks the company acted fairly.

As the party with responsibility to provide full details of the insurance, the lender is expected to have more evidence on what happened to back up its case.

In the last six months, of the cases that needed to go as far as the Ombudsman, 88% were awarded in consumers' favour. And even if yours isn't, there is no penalty for losing - it just means you don't get the money back.

The Ombudsman will then send you a confirmation letter to say it'll look into your case and get back to you if it needs any more information.

Sometimes this will take a long time, usually around a year but may be even longer as the Ombudsman deals with huge numbers of complaints. But don't worry - you can leave the matter to the Ombudsman to resolve and it will contact you with any offers from your lender.

If you think the Ombudsman wrongly turned you down

The Ombudsman's decision is usually made by an assigned case worker, but if you disagree with the result you can ask for a formal decision to be made by one of the 41 actual Ombudsmen at the service. This usually takes several months as it involves a detailed investigation into your case, but don't be afraid to push your complaint further if you think the initial decision isn't right.

After that, while the finance company must accept the Ombudsman's decision, you still have the right to take the company to court. It's also worth noting that if you feel the Ombudsman hasn't handled your case correctly, eg, there have been unnecessary delays, you can refer it to the Ombudsman's Service Review Team.

If that doesn't resolve it you've a right to go to the Independent Assessor, though this is only about quality of service, not the actual decision made.

Misleading Commercial Practices: Unfair Trading Regulations 2008

The practice of incorrect or misleading descriptions, statements, marketing and pricing was made unlawful under the both the Consumer Protection Act and the Trade Descriptions Act. This legislation has now been replaced in large part by the Consumer Protection from Unfair Trading Regulations 2008. The regulations outlaw three specific practices:

- Misleading actions.

- Misleading omissions

- Aggressive sales tactics.

1. Misleading Action

If false or inaccurate information has been used in relation to a product or a service, and this information has induced you into a purchase you would not have otherwise made, you can claim that the action was misleading. It also covers assertions made about the company selling to you. If, for example, the company makes untrue claims to have certain qualifications, or that they are members of an approved trade organisation, this is a misleading action. This is also the case if they claim to adhere to a code of practice which they then do not follow.

2. Misleading Omissions

The problem may be not what is stated but what is not. Therefore if information is omitted or hidden, presented in an unclear, unintelligible or ambiguous way, or given too late to the consumer, then it can be found to be misleading and in breach of the regulations.

Companies are required by law to include certain information about themselves , about performance of their contractual obligations, or in relation to consumer rights where there is a cooling off period. If they do not, then this is also misleading.

Incorrect Pricing

Incorrect or misleading pricing information is a common cause for complaint and is covered in these regulations.

Firstly, you should be clear that shops are not legally obliged to sell you their products and reserve the right not to do so if they wish. This means that if you pick up something which is wrongly priced, you do not have a right to buy it at that price. Having said this however, it is still unlawful for shops and suppliers to display an item at a price which is different to the price requested at the point of sale. Exceptions to this are obvious mistakes where, for example, a TV is priced at £8.99 instead of £899.00. An action is also misleading if it includes the manner in which the price is calculated and whether the item is being marketed as ‘discount’ or ‘for a limited time only’ – when in fact it is not.

Firstly, you should be clear that shops are not legally obliged to sell you their products and reserve the right not to do so if they wish. This means that if you pick up something which is wrongly priced, you do not have a right to buy it at that price. Having said this however, it is still unlawful for shops and suppliers to display an item at a price which is different to the price requested at the point of sale. Exceptions to this are obvious mistakes where, for example, a TV is priced at £8.99 instead of £899.00. An action is also misleading if it includes the manner in which the price is calculated and whether the item is being marketed as ‘discount’ or ‘for a limited time only’ – when in fact it is not.

Where the price given does not include taxes, delivery charges or any additional surcharges such as handling or admin fees, this is considered to be a misleading omission.

3. Aggressive Sales Tactics

When buying an electrical product we are frequently confronted with the option to buy additional insurance policies in the form of extended warranties. Sales staff can get generous commission for convincing us to part with more cash through the sale of these policies and this has led to aggressive sales tactics. The regulations aim to stamp out such practices if they are considered to impair your freedom of choice or limit your ability to make an informed decision. This includes harassment, coercion, persistence, threatening or abusive language, exploitation of misfortune or specific circumstances. It also includes retailers’ standing in the way of your contractual or consumer right to terminate a contract or switch to another product. However you must also prove that the way you were treated led you to make a purchase decision you would not otherwise have made.

Taking action against retailers

The regulations referred to here are within the scope of criminal law. What this means for the consumer is that you cannot take direct action against retailers if you find them to be in breach of any of the above. Instead, you would need to report the matter to the enforcement authorities (Trading Standards), who will investigate, and perhaps even prosecute. A prosecution would not be carried out on the consumer’s behalf but on the state’s behalf, and so you will not yield any personal benefit from this process (unless perhaps a feeling of satisfaction!).This is not to say that you cannot threaten to inform the authorities if they do not resolve the situation to your satisfaction within a reasonable time period.

Gym Membership Advice

For years, the OFT have been keeping a close eye on health and fitness clubs with specific reference to the fairness of their gym membership contracts. Typically, consumers have been required to sign agreements which commits them to a 12 month minimum term, which absolutely ties them in to making the monthly payments for that period. Many consumers have complained that gyms will not release you from this obligation under any circumstances, even in cases of serious illness, redundancy or relocation. Other complaints relate to long notice periods for cancellation and disproportionately high cancellation penalties.

The OFT have focused on the following aspects of contracts for gym membership:

- Claims that gyms will not be liable for death or personal injury, or for loss or damage to property

- Lack of clarity concerning minimum membership periods and notice required for cancellation

- Lack of clarity concerning cancellation charges, or the consequences of cancellation

- Clubs permitting themselves to make changes to their service agreements with you

In addition, the OFT felt that many of the obligations and requirements of the consumer were hidden within complex legal language when they should have been more plainly and clearly expressed. And while gyms could be allowed to impose an initial 12 month minimum term, consumers should be in no doubt on reading the contract that this would be the case. What about long notice periods for cancellation? A three month period is commonly the length of time required, which may seem unfair as it then ties you into a further 3 monthly payments. The OFT recognise that gyms also need to protect themselves from sudden cancellation and don’t consider 3 months to be excessive where you have a ‘rolling’ membership (i.e. not a minimum term contract). However, as with the imposition of a minimum term, this must be plainly and clearly expressed in the contract.

So what is an unfair term and what just bad customer service? We have seen that some of the points above, although dubious are not necessarily unlawful. However, the following are are unfair terms and have been recognised as such as a result of the OFT’s investigation:

- Limiting or excluding liability for death or injury, or for damage or theft of property (includes ‘at your own risk’ disclaimers)

- Excluding liability for any breach of contract on the club’s part, even though you are obliged to fulfil your contractual obligations

- Limiting your ability to take legal action against the club if they don’t comply with their contractual obligations

- Excluding certain statutory rights such as your right to get a refund if the club is unhygeinic or unsafe

- Financial penalties on cancellation, where this sum is disproportionately high. Loss of all monies paid in advance may also be unfair, where this cannot be justified by the gym

- Allowing the gym to terminate or cancel the agreement without reasonable notice, legitimate cause (as per contract), and giving you the same rights.

- An initial minimum term is permissible, but where this includes an automatic renewal to another fixed term, this is likely to be unfair. Similarly, automatic renewal without giving you reasonable opportunity to cancel is unfair.

In addition to the identification of unfair clauses, the OFT recognise that you may not have had the opportunity or the know how to read and fully understand the contract you are asked to sign. Consequently, contracts are required to be written in plain and intelligible language with a prominent warning that the member should read and understand the terms before signing them.

Take Care!

Despite the interest of the OFT, the situation still calls for buyer beware, and care should be taken before entering into such agreements. Bear in mind the following points, because there is no cooling off period!

- Take the time to read through the Ts and Cs. Take it away if necessary – it is your right to have reasonable opportunity to familiarise yourself with the contractual terms before signing.

- Take particular note of clauses in relation to tie-ins, notice periods and cancellation penalties. Do not mistake the notice period for cancellation with the length of the contract.

- If the contract contains clauses which refer to automatic membership renewal, ask for this to be removed, or make a note of the date by which you should inform them.

- By law, the contract must be presented in simple, jargon-free language. if you are unsure about anything ask for full clarification

- A contract is a two-way process. Don’t be afraid to ask certain clauses to be struck out if they seem unreasonable or you are not happy.

- Take extra care with introductory offers and special deals. Clubs may waive their joining fee but still charge you the equivalent as an ‘admin’ fee. Always read the small print.

Debt Collection Agencies

Debt collection is big business. As the use of Debt Collection Agencies (DCAs) increases, so have the number of complaints from the general public regarding the underhand, intimidating and often unlawful practices they are resorting to. Complainants also cite frequent examples of being mixed up with debtors who used to live at the address where they are currently living.

While there are still no laws governing what DCAs can and cannot do, the OFT have produced guidelines in relation to acceptable and unfair practices, breach of which may result in revocation of their licence. The OFT regard the following practices to be unfair practices:

- Frequent and / or threatening phone calls

- Being contacted at unreasonable times

- Refusing to deal with the debt advisor and contacting the debtor directly

- Failing to investigated disputed debts

- Threatening court action and not describing the process accurately

- Pressurising debtors to pay in full, in unreasonably large instalments, or to increase payments when they are unable to do so

- Requesting the debtor takes on further borrowing to finance a repayment

Remember that DCAs are not bailiffs and have no right to enter your home or visit your place of work. You are within your rights to ask them to leave and they must do so. They may only visit you at home where you have been given reasonable warning of a visit and have been given the opportunity to take legal advice beforehand. Where you have engaged the services of a debt management company to manage your debt and negotiate with creditors on your behalf, you can insist that DCA deal only with them, and not with you directly. If you query or dispute a debt – and remember it is your right under s 77-79 to request to see your credit agreement and statement of debt from the creditor, then the DCA must not continue with debt recovery activities during this time.

How to report DCAs for unfair practices

If a representative from a DCA approaches you in a threatening or inappropriate manner, if he/she gives you misleading information, or make unreasonable requests, or if they communicate with you in a way which has been communicated to them as being against your wishes, then they may be engaging in unfair practices. The creditor is responsible for ensuring that the DCA they use are professional, ethical and fair. You are able to report both the creditor and the DCA to the OFT via their complaints form. If your complaint is upheld and the OFT find them to be engaging in unfair practices, they can revoke their licence to prevent them from trading any further.

Debt Management Companies

In the current climate, debt management is big business. Dozens of debt management companies (DMCs) have sprung up over the last few years, having found a way to capitalise on this growing market, while at the same time claiming that they can help you out. There are two questions to ask yourself when thinking about involving a DMC: Firstly, do you really need one? Maybe you can formulate your own debt management plan and deal with creditors yourself. Secondly, under what terms do they operate? It may appear to be a free service, but all too frequently you will get talked into signing up to debt management service which is not free.

Debt Counselling

There is a huge selection companies offering debt counselling over the phone, nearly all of whom offer a free service. There are publicly funded organisations such as Citizens Advice Bureau and National Debtline, as well as not-for-profit charities such as Payplan and the Consumer Credit Counselling Service. There are also a host of other organisations who also offer debt counselling via a freephone number. The important thing to note about any of these companies is that they may advise with a view to getting you to agree to one of a range of a debt solution services. And these services are likely to incur a fee.

Debt Solutions

Debt management companies (DMCs) will offer the following options as debt ‘solutions’:

- Debt management plan

- Individual voluntary arrangement (IVA)

- Debt consolidation

Some companies, such as Payplan, get their fee from the credit industry rather than from you. The majority however are not offering the service out of the goodness of their hearts and must recover their fee somehow. This may be done in a number of ways – an up-front or set-up fee, a monthly management fee, or as a sum which is incorporated into the new debt. It is something to be aware of before you commit, although this information may not be immediately obtainable.

As a first step, you may want to deal with your own debts rather than involve a third party. National Debtline can send you a self-help pack which will enable you to do this (there is a link at the bottom of this page). The process involves assessing your income, expenditure, priority debts and non-priority credit debts. You can then choose to deal with your creditors yourself, by using the forms and letters in the pack to make offers of payment to them, in line with your personal budget.

Debt Management Plan (DMP)

A Debt Management Plan or DMP will be managed on your behalf by a debt management company (DMC) who will negotiate with your creditors to reduce your payments and potentially freeze interest payments. In turn you must pay them one monthly fee, which they will divide up and divide amongst your creditors for you. Additionally, if you are being pursued by debt collection agencies (DCAs), you can also request they deal with the DMC rather than with you. However, this is not a free service and the fee you pay will usually be integrated into your monthly fee. The reduced payment may seem like a good option, and it can be, but there are implications of managing your finances in this way:

- DMPs are suitable for smaller, short-term debts and for individuals who own their own home and have a regular income.

- The lowering of monthly payments will extend the repayment period of the debt as a whole. And a longer term means more monthly fees payable to the DMP agency.

- Despite assurances from the agency, they may not be able to get your creditors to agree to the reduced payments or freezing of interest. Therefore they cannot guarantee that your creditors won’t take action against you.

- DMCs usually only deal with non-priority debts, leaving you to deal with more serious debts such as mortgage or council tax arrears

- Your credit file will contain details of your DMP, which will affect your ability to get credit in the future.

Individual Voluntary Arrangements (IVAs)

An IVA is similar to a DMP but involves more serious sums of long term debt (more than £15,000). This option involves commissioning the services of an IVA provider, who will negotiate with creditors and manage the debt on your behalf. The IVA provider must first get your creditors to agree to write-off a portion of your debt, so that you can make monthly repayments you can afford. The repayments will be spread over 5 years and the arrangement will take the form of a legally binding agreement. The agreement will be presented to you in the form a proposal which will agreement will then be legally binding. An IVA is a good alternative to bankruptcy for those suffering under major longer term debt, although there are some significant implications:

- The potential for disproportionately high arrangement fees payable to the IVA provider which are added on to the overall cost. Shop around.

- Because it is a legally binding agreement, your failure to keep up the repayments may lead to bankruptcy

- Your credit file will contain details of your DMP, which will affect your ability to get credit in the future.

Debt Consolidation

Unlike a DMP or an IVA, a consolidation loan is the borrowing of more money to pay off existing debt. It is frequently offered as a solution to the problem of a having debts are spread across a variety of sources such as loans, credit cards and unpaid bills. While a consolidation loan will tie up all your existing debt and reduce the amount of money you have to pay as a whole, it is important to be aware of the following:

- Consolidation loans are only offered to homeowners, which means it is secured on your home. This has two implications: firstly it is not a regulated credit agreement and you will not have the benefit offered by the Consumer Credit Act. Secondly failure to keep up repayments may mean repossession.

- The lowering of monthly payments will extend the repayment period of the debt as a whole.

- You will have additional fees to pay to the loan provider which will increase the total amount you have to pay back.

How To - Access Your Credit File

If you have been turned down for a credit agreement such as a loan or a credit card, you have the right, under the Consumer Credit Act, to request that the lender provides you with details of the credit reference agency they used to access your credit file. You must do this in writing within 28 days and the lender must respond to your request within 7.

You can then write to that credit reference agency, to request a copy of your file, enclosing a fee of £2. As long as you have supplied all required information to the agency in order for them to verify your identity, they must send you your file within 7 days. If they hold no information about you, they must inform you but are under no obligation to return your fee. It is also their duty to ensure reports are in plain English and you are aware of your right to correct any wrong information.

The right to correct or amend any wrong information in your credit file

If an entry is incorrect and you feel this is likely to prejudice any decision against you regarding applications for credit, you can request this detail be corrected or removed. If the agency uphold your request, they must then write to you within 28 days telling you what has been done and (if applicable) send you the amended entry. Furthermore, the agency must notify each and every company which requested your credit file within the last 6 months that this has occurred.

The three main credit agencies in the UK are:

Equifax plc

PO Box 1140

Bradford

BD1 5US

Tel: 0870 514 3700

Experian Limited

Consumer Help Service

PO Box 8000

Nottingham NG1 5GX

Tel: 0870 241 6212

Callcredit plc

PO Box 491

Leeds LS3 1WZ

Tel: 0870 060 1414

You can then write to that credit reference agency, to request a copy of your file, enclosing a fee of £2. As long as you have supplied all required information to the agency in order for them to verify your identity, they must send you your file within 7 days. If they hold no information about you, they must inform you but are under no obligation to return your fee. It is also their duty to ensure reports are in plain English and you are aware of your right to correct any wrong information.

The right to correct or amend any wrong information in your credit file

If an entry is incorrect and you feel this is likely to prejudice any decision against you regarding applications for credit, you can request this detail be corrected or removed. If the agency uphold your request, they must then write to you within 28 days telling you what has been done and (if applicable) send you the amended entry. Furthermore, the agency must notify each and every company which requested your credit file within the last 6 months that this has occurred.

The three main credit agencies in the UK are:

Equifax plc

PO Box 1140

Bradford

BD1 5US

Tel: 0870 514 3700

Experian Limited

Consumer Help Service

PO Box 8000

Nottingham NG1 5GX

Tel: 0870 241 6212

Callcredit plc

PO Box 491

Leeds LS3 1WZ

Tel: 0870 060 1414

Credit Agreements - Your Rights & Explained

There is a wealth of ways in which retailers make high priced items affordable – you can choose to ‘buy now pay later’, or spread the cost in monthly instalments, or both. You may choose to get an independent loan or finance it through a new credit card. Whatever method you choose, you will be party to a consumer credit agreement, which may involve third party finance. The vast majority of credit agreements are regulated by the Consumer Credit Act, which has important implications for in terms of how financial information is presented, your rights under the Act and whether you are able to cancel the agreement.

In addition to credit and store cards, personal loans and overdrafts, a credit agreement will govern the following types of contracts:

Finance options for the purchase of goods and services (credit sale agreements)

Hire purchase agreements

Hire agreements

Conditional sale agreements

Credit sale agreements

This is the most common type of financing option when purchasing high-priced goods and services such as cars, electronic goods, or home improvements. It is basically a loan to over the purchase price of the item, with the loan paid back the loan in equal monthly instalments over several months or even years. The consumer (the ‘debtor’) may pay a large initial deposit (such as with the purchase of a car), or not pay anything at all for the first year or two. Either way, you will legally own the goods as soon as the credit sale agreement is made, even if you have paid nothing at all. Where ‘interest-free credit’ is advertised, you will have a specified time to pay back the outstanding balance, otherwise the due balance will automatically roll into a longer term credit agreement where interest will be payable.

Hire purchase (HP) agreements

Under this arrangement, you will pay monthly instalments to hire the item, but will not legally own it until the final instalment has been paid. This type of agreement may also give you the option to buy with a lump sum at the end of the period, such as with ‘balloon payments’ on car finance.

Hire agreements

This is simply the hire of goods at a (usually low) monthly fee. You will never own the item, but must keep up the payments for the term of the contract to avoid having the goods repossessed and being sued for the outstanding debt.

Conditional sale agreements

This is very similar to the HP agreement described above. Even though you will be in possession of the goods in question, you will only own them on the condition that you have paid all the instalments. However, the agreement may also specify other conditions to be met before ownership can take place.

Look at the figures

In order to see exactly what you will end up paying and so that you can compare the cost of different agreements over different timeframes, the Consumer Credit Act requires companies to clearly present key financial information, including:

The loan amount

The charge for credit

The total amount payable

The monthly instalments

The Annual Percentage Rate (APR)

As this example shows us, by opting to buy now pay in 12 months in 36 monthly instalments you could be paying a good 80% more (£540 extra) on the original price. The APR must also be shown to illustrate how ‘expensive’ the credit is. It also enables you to shop around for the best deal.

Order Value £750.00

Deposit £75.00

Loan Amount £675.00

Total Charge for Credit £544.76

Total Amount Payable £1294.76

Arrangement Fee £42.00

Can I get out of the agreement?

Whether or not you have a cooling off period depends how the contract was made. Where you have been presented with the paperwork to sign on trade premises, it is legally binding from the moment they are it is signed. If you entered into the contract at a distance – over the phone, via the internet, by post, or if you dealt with a broker, then you will have a cooling off period of 14 days (30 days for some products).

Terminating and early repayment

You can terminate an HP or conditional sale agreement at any time before payment of the last instalment, provided you have paid at least one half of the total price and you have taken reasonable care of the goods to be returned. For hire agreements you can only terminate the agreement after 18 months (unless an earlier date is mentioned on the contract).

The Consumer Credit Act gives you the right to repay the debt early and complete the payments ahead of time, as long as you provide written notice to the lender of your intention to do so. You will also be able to get a statutory rebate for the charge for credit. The rebate must also be calculated according to regulations set out in the Act – not of the lender’s choosing!

If you default on payments

If you have missed (defaulted on) at least two or more payments (i.e. you are in arrears), the lender will, within 14 days, send you a notice of default which will explain fully your obligations and risks. It will tell you how behind you are in your payments, what action you must take and when, and whether any additional sums of money (default sums) have been incurred as a result. It also informs you of the consequences of ignoring the notice and what the lender is entitled to do, which may involve any or several of the following:

To terminate the agreement

To demand early repayment of any sum

To repossess the goods

Enforcement of security in lieu of what you owe (possible involvement of bailiffs)

The supplier cannot repossess goods without serving you with this notice and waiting for the required time to enable you to respond (14 days).

If you cannot afford the repayments

If you are already in default and you have received a notice to this effect, or the company has started proceedings against you, you can apply for a ‘time order’ from the courts. If successful, this will give you a longer amount of time to pay, in the context of your personal situation. To avoid further action from the lender in the meantime, you must write to them advising them of your intentions.

If you are not yet in default but feel that you will have difficulty meeting the monthly instalments, you are advised to contact the lender (the supplier or the finance company) without delay informing them of the situation. Also seek help from one of the numerous debt advice agencies such as National Debtline who will be able to set up a Debt Management Plan (DMP), negotiate with creditors on your behalf to help you get back on track with your repayments and avoid potential legal proceedings.

In addition to credit and store cards, personal loans and overdrafts, a credit agreement will govern the following types of contracts:

Finance options for the purchase of goods and services (credit sale agreements)

Hire purchase agreements

Hire agreements

Conditional sale agreements

Credit sale agreements

This is the most common type of financing option when purchasing high-priced goods and services such as cars, electronic goods, or home improvements. It is basically a loan to over the purchase price of the item, with the loan paid back the loan in equal monthly instalments over several months or even years. The consumer (the ‘debtor’) may pay a large initial deposit (such as with the purchase of a car), or not pay anything at all for the first year or two. Either way, you will legally own the goods as soon as the credit sale agreement is made, even if you have paid nothing at all. Where ‘interest-free credit’ is advertised, you will have a specified time to pay back the outstanding balance, otherwise the due balance will automatically roll into a longer term credit agreement where interest will be payable.

Hire purchase (HP) agreements

Under this arrangement, you will pay monthly instalments to hire the item, but will not legally own it until the final instalment has been paid. This type of agreement may also give you the option to buy with a lump sum at the end of the period, such as with ‘balloon payments’ on car finance.

Hire agreements

This is simply the hire of goods at a (usually low) monthly fee. You will never own the item, but must keep up the payments for the term of the contract to avoid having the goods repossessed and being sued for the outstanding debt.

Conditional sale agreements

This is very similar to the HP agreement described above. Even though you will be in possession of the goods in question, you will only own them on the condition that you have paid all the instalments. However, the agreement may also specify other conditions to be met before ownership can take place.

Look at the figures

In order to see exactly what you will end up paying and so that you can compare the cost of different agreements over different timeframes, the Consumer Credit Act requires companies to clearly present key financial information, including:

The loan amount

The charge for credit

The total amount payable

The monthly instalments

The Annual Percentage Rate (APR)

As this example shows us, by opting to buy now pay in 12 months in 36 monthly instalments you could be paying a good 80% more (£540 extra) on the original price. The APR must also be shown to illustrate how ‘expensive’ the credit is. It also enables you to shop around for the best deal.

Order Value £750.00

Deposit £75.00

Loan Amount £675.00

Total Charge for Credit £544.76

Total Amount Payable £1294.76

Arrangement Fee £42.00

Can I get out of the agreement?

Whether or not you have a cooling off period depends how the contract was made. Where you have been presented with the paperwork to sign on trade premises, it is legally binding from the moment they are it is signed. If you entered into the contract at a distance – over the phone, via the internet, by post, or if you dealt with a broker, then you will have a cooling off period of 14 days (30 days for some products).

Terminating and early repayment

You can terminate an HP or conditional sale agreement at any time before payment of the last instalment, provided you have paid at least one half of the total price and you have taken reasonable care of the goods to be returned. For hire agreements you can only terminate the agreement after 18 months (unless an earlier date is mentioned on the contract).

The Consumer Credit Act gives you the right to repay the debt early and complete the payments ahead of time, as long as you provide written notice to the lender of your intention to do so. You will also be able to get a statutory rebate for the charge for credit. The rebate must also be calculated according to regulations set out in the Act – not of the lender’s choosing!

If you default on payments

If you have missed (defaulted on) at least two or more payments (i.e. you are in arrears), the lender will, within 14 days, send you a notice of default which will explain fully your obligations and risks. It will tell you how behind you are in your payments, what action you must take and when, and whether any additional sums of money (default sums) have been incurred as a result. It also informs you of the consequences of ignoring the notice and what the lender is entitled to do, which may involve any or several of the following:

To terminate the agreement

To demand early repayment of any sum

To repossess the goods

Enforcement of security in lieu of what you owe (possible involvement of bailiffs)

The supplier cannot repossess goods without serving you with this notice and waiting for the required time to enable you to respond (14 days).

If you cannot afford the repayments

If you are already in default and you have received a notice to this effect, or the company has started proceedings against you, you can apply for a ‘time order’ from the courts. If successful, this will give you a longer amount of time to pay, in the context of your personal situation. To avoid further action from the lender in the meantime, you must write to them advising them of your intentions.

If you are not yet in default but feel that you will have difficulty meeting the monthly instalments, you are advised to contact the lender (the supplier or the finance company) without delay informing them of the situation. Also seek help from one of the numerous debt advice agencies such as National Debtline who will be able to set up a Debt Management Plan (DMP), negotiate with creditors on your behalf to help you get back on track with your repayments and avoid potential legal proceedings.

Subscribe to:

Posts (Atom)